Do international students have to file a tax return this April?

March 4, 2020

The answer is always “yes.” Students need to at least file a federal tax return, and possibly a state tax return, by April 15.

I can’t remember how many conversations I’ve overheard from an international students group about tax returns that always ended up with “what is a tax return” and “I didn’t know I need to do that.” I too, have asked those questions to an American friend whose blank look reminded me that tax returns, despite being nonexistent in most other countries, are a mundane thing in the U.S.

So, “What is a tax return?” The Internal Revenue Service (IRS) doesn’t specify the definition of what a tax return is on their website, however, here is an important point know:

“All international students and scholars are required to file a U.S. federal tax return, even if you do not have a source income from the U.S.,” according to the Northeastern Office of Global Services.

Filing a tax return can be challenging to international students who are not familiar with the process, so it is good to start early. At the end of January, I received an email from my university’s Office of Global Services with instructions on how to file, for free, with a tax preparation service called Sprintax.

It is important to note that just because you need to file, that does not necessarily mean that you have to pay more taxes to the U.S. government. Sometimes you might get a refund from the IRS. In fact, the OGS stated in the email sent out to students that “Sprintax was used by over 165,000 international students and scholars last year, and the average Federal refund received by eligible students was over $1,087.”

In my case, I received income for my co-op in 2019. After filing for my tax return, I found out that was eligible for a tax refund from the IRS, meaning the agency will send me a check after I have filed my tax returns.

Additionally, according to the IRS, the U.S. has income tax treaties with a number of foreign countries. Under these treaties, “residents (not necessarily citizens) of foreign countries may be eligible to be taxed at a reduced rate or exempt from U.S. income taxes on certain items of income they receive from sources within the United States.” This means that residents of some countries that have a tax treaty with the U.S. might not even have to pay income tax at all.

Vietnam, where I come from, doesn’t have a tax treaty with the U.S. but plenty of other countries do, so it is worth checking if your country is on the list.

So what if you didn’t receive any income in the past year? According to the OGS, students who did not receive income will only have to file a federal tax return, whereas students who received income in 2019 will need to file a state tax return too. “They can do those through Sprintax as well, but will need to pay for that filing service,” according to the OGS. Note that there is a distinction here between “federal tax return” and “state tax return.” Since I did receive income for my co-op in 2019, I need to file for both.

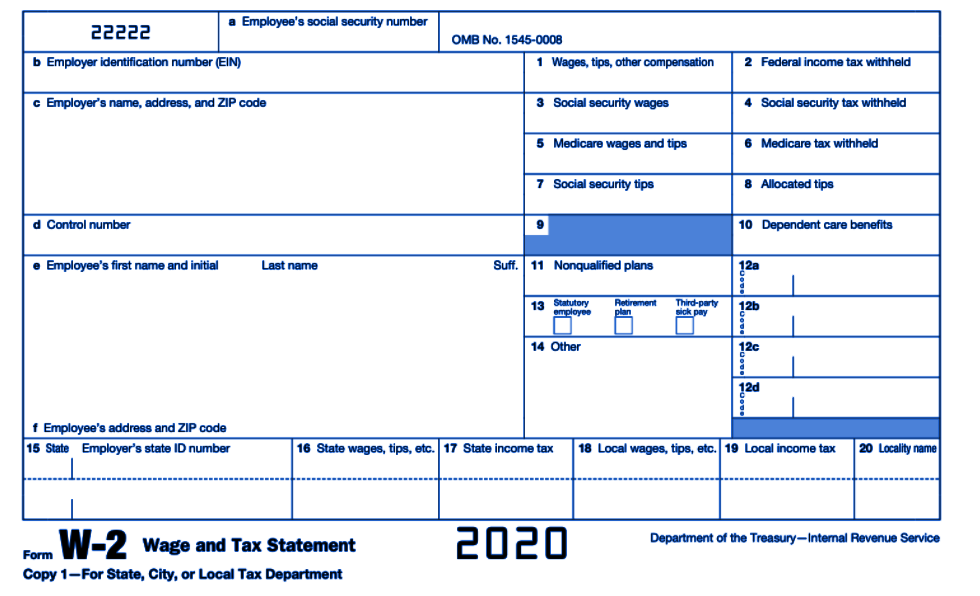

My first step before starting to file the tax return with Sprintax was to get the W-2 Wage and Tax Statement Form from my employer, which looks like this.

To start the tax filing process, I registered an account with Sprintax. I then filled in some personal information, and uploaded the W-2 form from my employer. After all the appropriate documents were uploaded, Sprintax prepared my tax returns (both federal and state) after a few seconds.

When you check out (pay), remember to apply the “unique code” provided by Northeastern in the email – this will enable students to file the federal tax for free. While my federal tax return was free, I needed to pay to file a state tax return, which costs $25.95 on Sprintax.

Finally, after you pay, follow Sprintax’s instructions on what to do next to mail the tax returns documents that it has prepared for you to the right place.

Other suggestions to students while filing a tax return, from the OGS:

- Read the OGS website carefully, write down your questions and bring them to the information session.

- Wait to start filing until after attending a tax information session, if there is one available at your school. If you are a Northeastern University student, the Northeastern University OGS has an information session coming up, on March 17, with information about signing up and a lot more info about filing taxes for Northeastern students is on their webpage here. Any tax documents from employers or investments that are being mailed to you (such as a W-2) should have arrived by then.

- Be careful of where you receive specific tax advice online – university websites, government websites, and tax filing services are good sources. Blog posts, friends, or social media are more likely to have misleading or incorrect information.

- Sit down with friends in the library and work through each step on Sprintax together so that the task feels manageable

- Make time to do your filing by the end of March so that in case you run into questions or concerns, you still have time to get help before the April 15 deadline

- Be aware of potential scams – the Internal Revenue Services (IRS) will NOT call your cell phone or demand your credit card number. If you think something might be a scam, you can contact the Police Department at your university or Boston Police Department before sending money.

The content of this article is not supposed to nor qualified as official advice from tax specialists. The writer and OGS staff quoted are not tax specialists and are not qualified to give advice, per the Office of the General Counsel. The article is only an informative piece for students to get started on getting familiarized with tax returns. Students should consult the OGS website of their school and follow the instructions there. Since the OGS staff are not tax experts, we refer students with specific questions to tax agencies or professionals, such as H&R Block.